Sri Lanka will sign six Double Taxation Avoidance Agreements (DTAAs) which has been pending for some time, to facilitate and encourage trade and investments, Inland Revenue Department (IRD) Commissioner General Nadun Guruge told the media last week.The DTAAs will be signed with Ukraine, the Maldives, Hungary, Cyprus, Austria and the agreement with the UK will be renewed. “The preliminary work on the agreements will be finalised shortly and the DTAA will be signed thereafter,” he said, adding that such agreements are essential to promote trade and investments. The Double Tax Avoidance Agreement (DTAA) is a tax treaty signed between two or more countries to help taxpayers avoid paying double taxes on the same income.

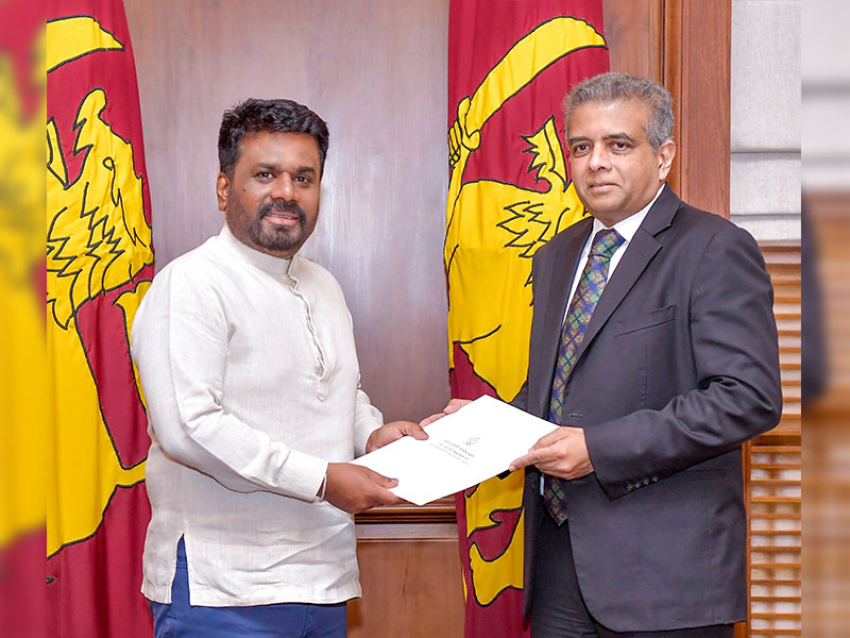

A DTAA becomes applicable in cases where an individual is a resident of one nation, but earns income in another. Sri Lanka signed a DTAA with Turkey in Ankara last week to improve transparency in tax matters and help curb tax evasion.“Such initiatives will help improve the flow of investment, trade activities and boost the tourism sector,” Guruge said. Turkey has a population of around 85 million and attracts around five million visitors each year. It also generates a tax revenue of around US$ 100 billion. Tax experts are of the view that double taxation treaties stimulate the flow of capital, technology and personnel from one country to another by eliminating the burden of taxation in both countries.

“DTAA will create a more attractive investment climate, giving an opportunity for foreign investors,” Guruge said, adding that since Sri Lanka signed the first such agreement with Britain in 1950, 46 such agreements have been signed with many other countries up to now. Some have also been updated to suit changes.DTAAs can be either be comprehensive, encapsulating all income sources, or limited to certain areas, which means taxing of income from shipping, inheritance and air transport. India has DTAAs with over 80 countries, with plans to sign such treaties with more countries in the years to come. Some of the countries with which it has comprehensive agreements include Australia, Canada, the United Arab Emirates, Germany, Mauritius, Singapore, the United Kingdom and the United States of America.

The intent behind a Double Taxation Avoidance Agreement is to make a country appear as an attractive investment destination by providing relief on dual taxation. This form of relief is provided by exempting income earned in a foreign country from tax in the resident nation or offering credit to the extent taxes have been paid abroad.Many developed countries which are capital exporting, prefer to tax the profits and income derived by such investment companies on the basis of its residency, while the capital importing, developing countries prefer to tax such profits on the basis of source, as the profits and income were generated therein. As double taxation hinders bilateral trade and investment, to provide relief from double taxation, countries enter into bilateral (or multilateral) agreements.While negotiating for a double taxation avoidance agreement, capital exporting countries prefer the model text of the Organisation for Economic Corporation and Development (OECD Model Text of Avoidance of Double Taxation.